Throughout the past two years we have seen a huge amount of changes along with the uncertainty that comes with it, none more so than in the business and tax world.

To help you stay up-to-date, we have compiled this list of top five things you need to know and what it all means for you in the current COVID-19 impacted business world.

Tell me more about it.

1. Is the cost of purchasing RATs tax deductible?

Following a hotly-debated topic in the past three months, the Federal Government announced on 7 February 2022 that the government will take action to ensure that COVID-19 tests are tax deductible, with the measure to take effect from 1 July 2021 (the 2021-22 income year) and also exempt from FBT for employers, effective from 1 April 2021 (the 2021-22 FBT year).

While this is great news for all taxpayers, Prosperity points out an important fact that changes in taxation law are not in effect until the law is enacted, the process of which involves parliamentary debate, before receiving royal assent once the amendment bill passes both houses of government. With only three months before election date in May 2022, there is no guarantee this will happen in time.

We also remind you that the usual tax deduction rules apply, being the cost must be in connection with your employment or business income, and you must keep sufficient records such as receipts.

Prosperity recommends you continue engaging with our team to keep up to date on any new developments in this area.

2. Are my COVID-19 support payments taxable income?

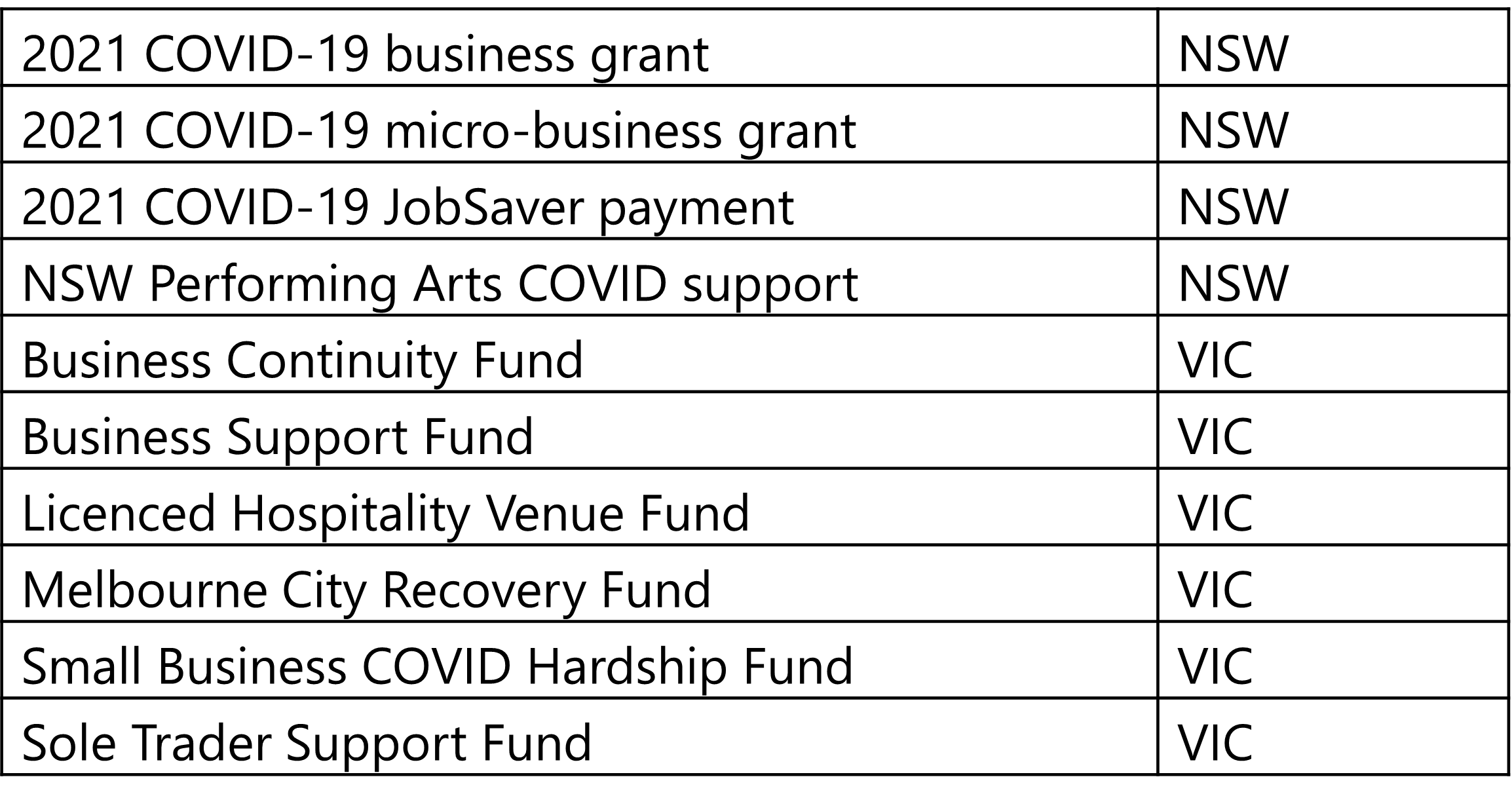

Both the State/Territory and Federal Governments have provided a range of COVID-19 related support packages since the start of the pandemic. The Federal Government passed legislation last year on 24 June 2021 to extend the concessional tax treatment of certain grants and support payments to be ‘non-assessable non-exempt’ (NANE) income. The list of NANE grants and support payments includes:

One of the key eligibility criteria to treat your grants and support payments as NANE is that your business must have an aggregated turnover of less than $50 million in either the income year the payment was received or the previous income year. If you do not satisfy this criterion, unfortunately any grants and support payments you receive must be included in your business’s assessable income.

What is NANE income? In short, receiving NANE income means you do not include the income in your assessable income, but you also cannot claim any deductions for expenses incurred to derive the NANE income.

3. What if I had provided COVID-19 vaccine incentives to my staff?

As a business owner, you may have provided incentives to your staff to get vaccinated and protect everyone from serious health effect of COVID-19. These incentives may be taxable or attract fringe benefits tax and you must be aware of the implications.

Generally any cash payments, including a bonus or allowance, will need to be included in your employee’s salary and wages with appropriate PAYG withholding deducted, as well as adding 10% superannuation guarantee. Your employees will need to include these payments in their tax returns as shown on their PAYG income statement.

If the incentive was a non-cash benefit such as gift cards, all-expense-paid holidays, gift of physical property or reimbursement of meal expense, these will be treated as a fringe benefit unless it is an exempt benefit.

With the 2022 FBT season coming up, come and speak with the Prosperity team about your FBT implications and proper recordkeeping requirements.

4. I’ve moved out of the city, can I claim my flights to the city for my weekly board meeting?

You may have decided to move your family out of the ‘big smoke’ to quieter rural life and manage your city-based business remotely, however you still need to attend board meetings or manage your business in-person. Are you able to claim a tax deduction for the flights and other transportation costs?

Unfortunately the circumstances that allow for a tax deduction for transportation costs are extremely limited and costs of travelling from your place of residence to your place of employment/business location for most taxpayers are not deductible.The primary testing factor is whether the obligation to incur transportation expenses arises out of the employment or business activity itself and not simply due to the taxpayer’s personal circumstances. Generally where a person chooses to live in a distant location to their place of employment or business this does not establish an employment purpose for any transportation costs between the two locations.

If you are impacted by this and you are unsure of the tax treatment, come and speak with the Prosperity team for a professional opinion on the matter.

5. My staff are working remotely from overseas, what do I need to know?

Your staff may have travelled overseas and has been unable to return to Australia due to the border restrictions in place, or it may be you that had to relocate overseas to be with family members but continue to run your Australian business from abroad. Do you still need to pay Australian tax?

As an employee, you will continue to be taxed in Australia on your employment income for as long as you remain an Australian tax resident. This will be true even if the foreign country treats you as a tax resident and you have to report and pay tax there. As an employer, you will need to continue to meet PAYG withholding and Superannuation obligations for your overseas-based employees as well as comply with Australian employment law until such time they are no longer an Australian resident.

As a business-owner, you must consider whether your presence overseas will create an overseas ‘permanent establishment’ and more importantly if you have companies, whether you can continue to meet the statutory requirement of having at least one Australian-resident director and public officer.

Depending on the length of time spent abroad and the level of business activities performed outside of Australia, the tax implications can become extremely complex both in Australia and overseas. Prosperity is part of LEA Global and we can provide you with appropriate professional advice wherever in the world you may be through our network of partner firms.

Don’t delay, come speak with Prosperity Advisers today!

To discuss any taxation concerns you have regarding anything in this article please contact Manager of Taxation, Charles Yuan at cyuan@prosperity.com.au.